Everybody has a story about an unpleasant email. One of the numerous email errors that we all desire to correct. That too, as soon as we become aware of it. Instances include sending an email to the incorrect recipient, failing to include a file, sending an inflammatory email in the midst of a crisis, and making funny typos. Recalling emails is one technique to fix those errors.

Whatever the reason, there are occasions when you truly have to pull an email out of limbo. Outlook has a feature for doing this. We’re here to explain to you how to recall an email in Outlook. So you can avoid scams. This may be one of the most crucial techniques you ought to be aware of.

Outlook’s recall feature has significant limitations, just as most recall tools. It can only be disabled by two competent employees. And only functions between two Outlook users on the Microsoft Exchange server. Fortunately, Outlook offers other recall options in addition to its native recall capability.

Effect of Recalling an Email

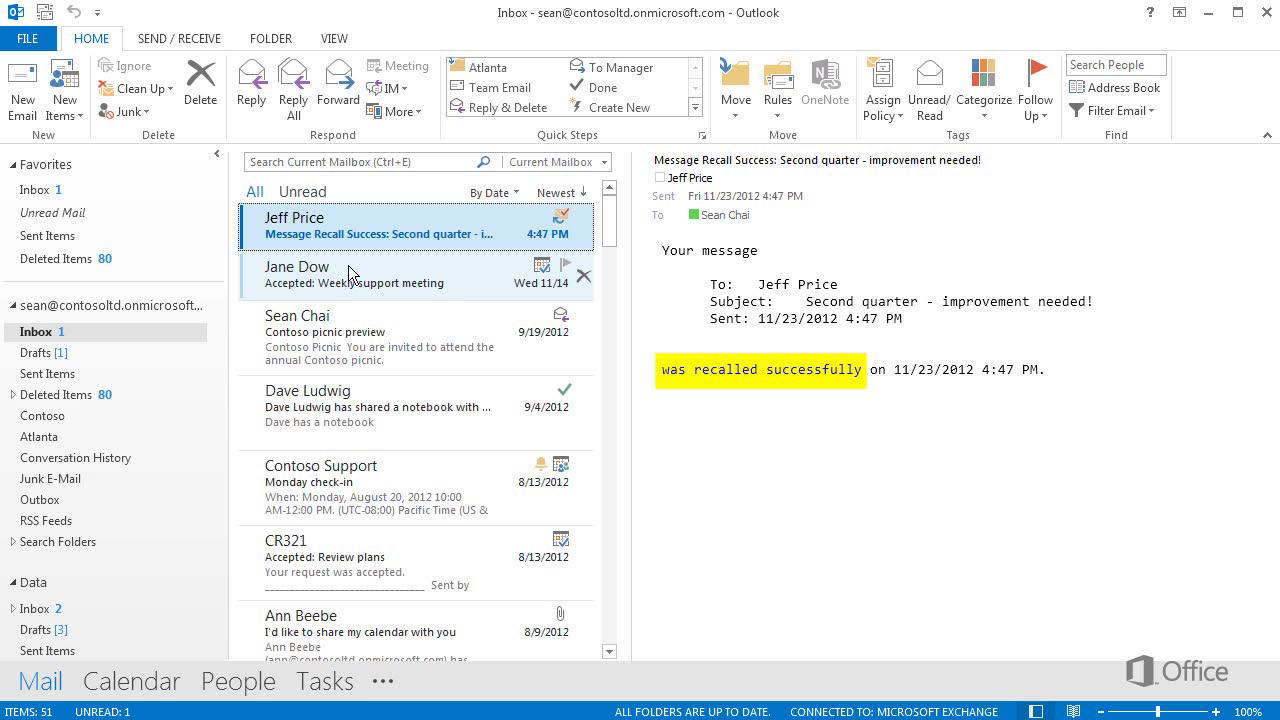

The user’s preferences determine what occurs when you instruct Outlook to recall or substitute an email. Below are various conditions that can affect whether an Outlook recall succeeds or fails when you send a message to someone and then retrieve the old message to substitute it with a fresh one. Please be aware that in each instance, the receiver will also obtain the recall email in addition to the original email.

The outcome of your effort to recall a message can change based on the recipient’s email client’s setup, if the initial message has already been viewed, and a number of other variables. Here are a few possible outcomes of an Outlook recall.

- The recall will not work if the receiver has already seen the message. The receiver has access to both the actual message and the updated email (or notification of your intent to recall the initial letter).

- The original message is destroyed if the receiver receives the recall message before opening the original one. The receiver is notified by Outlook that you removed the communication from their mailbox.

Recall only functions on untouched emails in the Outlook desktop software if both users are connected to the same Microsoft Exchange server. And, if the email hasn’t been viewed. Even then, the functionality can be quickly turned off by the receiver if they so choose. They can avoid the recall by opening the original letter first by going to Options > Mail and unchecking “Automatically handle meeting requests and responses to meeting requests and polls.” The feature is practically useless unless everybody you communicate with employs Outlook and configures it in a similar manner.

How Does It Operate?

A letter you sent can be recovered from the folders of receivers. That has not yet received it using the message recall feature in Outlook. Another option is to use an alternative email.

Must remember:

If you and the receiver both have a Microsoft 365 or Microsoft Exchange email address. That too, within the same organization, a mail recall is available. It will be done after you hit Send.

Steps on How to Recall an Email in Outlook

Microsoft Outlook is a crucial tool, especially if you’re a business person. You may take advantage of a number of improvements in Outlook to speed up interaction in a variety of ways: Backgrounds, fonts, signature files, and extras.

In addition, there is a useful tool that lets you know if the receivers of your emails are passing the time online. More crucially, you may recall any email with Outlook, which is one of its great attributes.

These are the steps on how to recall an email in outlook.

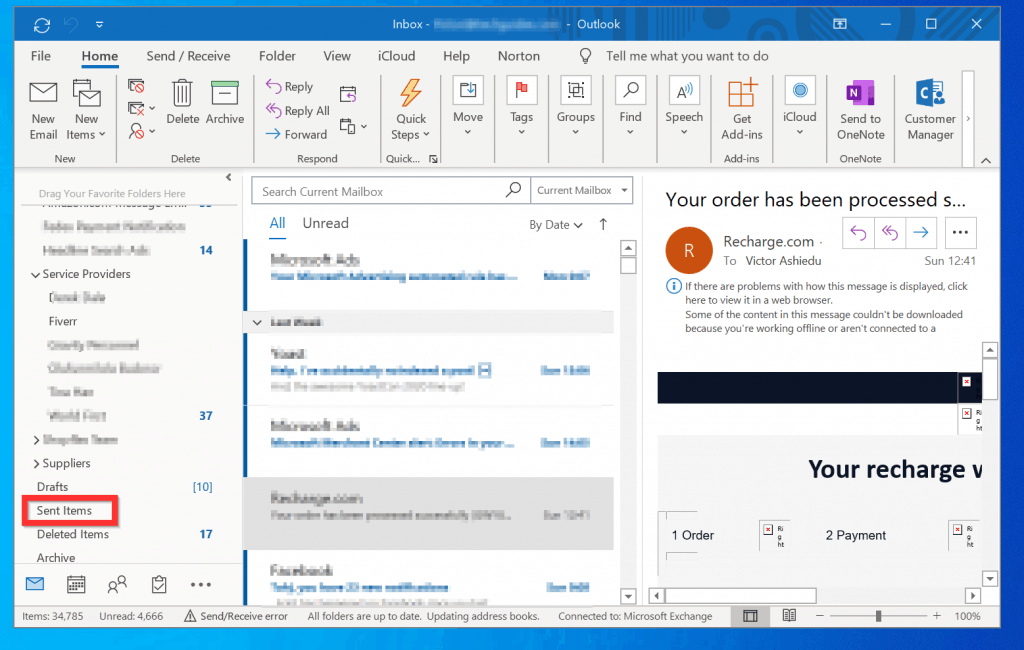

Step 1

Locate the email you wish to recall in the Sent Messages directory. If you’ve sent it shortly, it ought to be around the top of the pile. Tap it twice.

Step 2

On the toolbar located at the top, select the Message button. It will grow as a result. Take a peek at the Move area right now. You ought to see a logo for a mail service and an envelope there. Clicking on that enables you to see additional choices.

Step 3

Additional choices ought to appear. There, select the Recall This Message button. Depending on your system, choose the Message tab, tap the triple dots, choose Actions, and then choose Recall This Message.

Step 4

A pop-up screen should appear. There are two choices available to you: Delete Unread Copies of This Message or Delete Unread Copies and Replace Them with a New Message. You ought to have a choice that alerts you whether the procedure was successful or unsuccessful. According to your preferences, you can decide whether to allow it or prevent it.

Step 5

Outlook launches a new screen so you can evaluate the content if you decide to compose a substitute email. Outlook will bring up the previous email as you’re writing the new one. After making changes to the email, press the Send button.

Outlook’s email recall feature even enables you to replace an already-sent message with a fresh one that you’d like to edit. The best part is that the procedure is really rather easy, so we’re here to demonstrate it for you in case you want to avoid having an awkward talk with a coworker, client, or even simply a buddy.

Frequently Asked Questions Section

What should you do if the Recall This Message function is hidden?

If you don’t see the “Recall This Message” button, you might not have an Exchange server account. To find out what kind of email account each item in your Outlook profile is associated with. Go to Tools -> Account Settings -> E-mail and examine the Type field. It’s also conceivable that the recall option is hidden from you because your company does not support it.

Conclusive Insights

In Outlook, you can remember emails in this way. But do you realize how to recall an email the best? It is not at all recalled.

That means you should double-check your emails prior to delivering them. Considering that the receiver might read your email before you demand a recall. You’ll avoid some awkward situations with your coworkers. As a result, you will develop into a competent email marketer as a result.

All of this is to imply that you shouldn’t just rely on Outlook to save you if you accidentally send a crucial email to the wrong address. Or say something you later wish you hadn’t said for work-related reasons. The best way to avoid getting into that predicament is never to put yourself in that scenario in the first place.