It has somewhat become important these days to keep yourself healthy and fit. Pandemic has taken a toll on mental health. And this is because you are mostly restricted to one place. But then keeping the proper record of the travel and steps that you have taken is very much important. Miles tracking app is important for consistency and accuracy.

There are loads of miles tracking apps that help in keeping a tab on travels. There are some free mileage trackers that you can easily download. You will be able to track down the trips before you are an investment for any premium package. There are other miles tracking app (s) that you will get for a free version.

We have jotted down the best miles tracker app for businesses in 2021. Before we help in delving into the details, you ought to know about the deduction on business mileage.

The Process To Deduct Business Mileage

The self-employed people can leave on to their business location. If the business location is your house, you could deduct your mileage anyway (miles tracking app). The condition for the area is the trip location has to be only for work purposes.

Which miles are countable?

Here are the following day-to-day examples that you could opt for the mileage text deduction –

- Client Meeting

- Conducting Sales Call

- Going to the post office for shipment

You have to review that the mileage that is deducted should be “necessary and ordinary”. If you are driving for 20 miles to pick up inventory, and driving back the same distance to your workplace, the total deduction is 40 miles.

On the other hand, taking a 15-mile detour on the way back (because you may crave for a break/halt in between), the extra mileage is not deducted. Rather cannot be deducted. You may only deduct the 40 miles that you have travelled due to your business work.

What is self-employment’s basic mileage rate?

- Deducting mileage for your taxes is done through a standard per-mile rate. Considering the 2019 tax year, the rate was 58 cents. The concept is currently proportional to inflation. The continuation is the same that increases every year.

- For small trips around the town, the amount does not add up. But if it is about work calls or conferences, the standard mileage rate could take much out of your tax obligation.

- Furthermore, there are additional deductible expenses. This could be miscellaneous.

- Conduct guesswork on functioning your business with experts involved in your group members at a cost-effective rate. There are online platforms to seek help for the same.

Coming to the core factors on miles tracking apps, here are the top ones to use in 2021.

Best Miles Tracking App

Here is the list of best miles tracking app exclusively for your business meeting your needs and requirements.

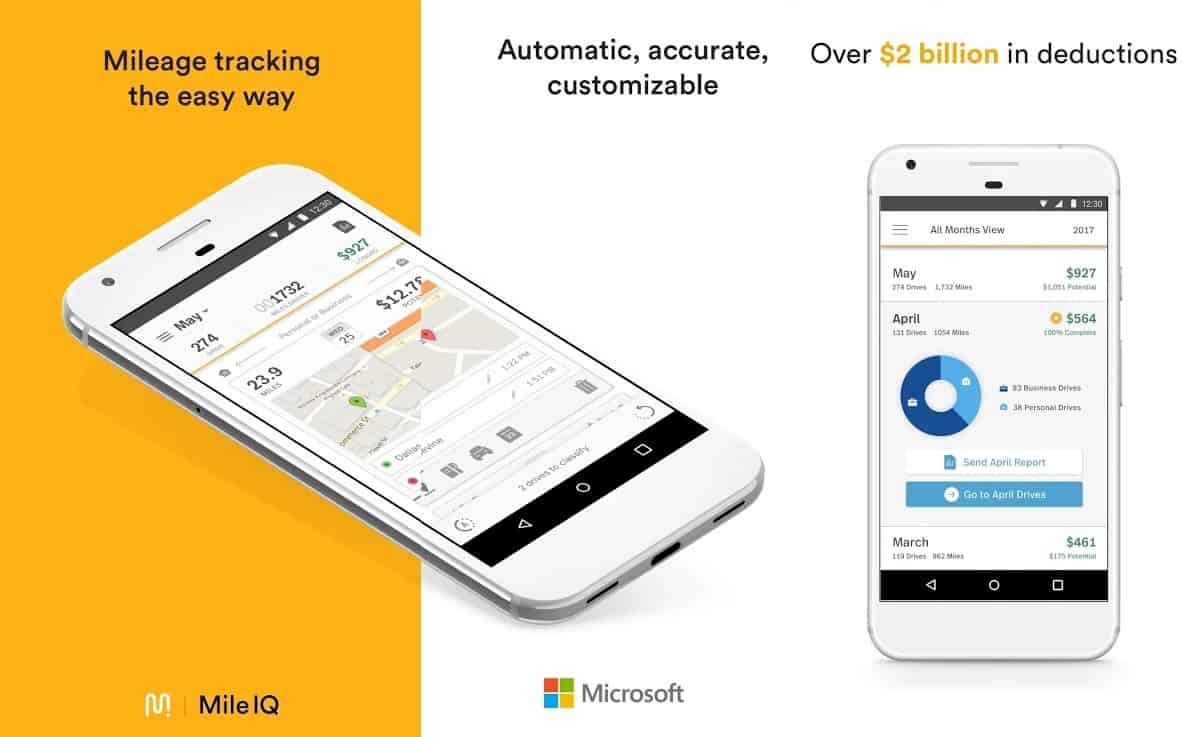

MileIQ

It gives you 40 free trips every month. For acquiring the premium version, it costs you like $5.99/month, or $59.99/year (paid annually)

Overview –

The full version of the application comes with updated Office 365 Premium. Rated on number one, MileIQ helps in tagging trips for “business”. Also, the app does take into account the route. It further helps in taking the same route for business. The pricing and the status might vary. MileIQ does not offer any sort of accounting functioning. It is only restricted to counting and classifying mileage. You cannot calculate tax deductions here.

Specifications –

Mileage Tracker –

The app has an automation facility that helps in detecting mileage while driving. It covers all expenses.

Working Hours –

Set the working hours as per the application’s automatic mileage tracking.

Integration with Freshbooks and Excel –

If you are using any of such apps, MileIQ helps in exporting reports to these applications.

Drawbacks –

MileIQ does not offer you everything. There is a lack of accounting tools. It tracks down only the mileage of driving and helps in classifying the trip.

What could it be best used for?

MileIQ is one of the best choices if you are driving for business. It also works if you have unrestricted hours, you can set your work hours.

SherpaShare

This is not completely a free application. There are two versions of the application –

Basic versions come with $5.99/month or $59.88/year (paid annually). On the other hand, the full version commences with $10/month.

Overview

SherpaShare can stand out from the crowd. It is best suited for rideshare drivers. SherpaShare comes with SmartDrive tools that help in tracking how much you’re earning. It then garners the information to let you earn more. The presence of a driver heatmap guides other drivers to operate through the same routeway strategically.

The application does not have a free version. It is better to review the terms and conditions before signing up for the same.

Specifications –

Unlimited, automatic mileage tracking –

You can easily cover unlimited trips every month. The tracking is done automatically through GPS.

SmartShare analytics for rideshare drivers

Helps in easily calculative revenue and profit. You can chat with other drivers. Other drivers can be active and garner recommendations related to the past driving experience.

Drawbacks:

The application is not a free one

What is it best suited for?

If you are the rideshare driver, you will find the application meeting your needs and requirements. But if you are not, it is always better to look for any other alternative.

TripLog

The free version of the application presents you with no automation tracking, restricted to only five vehicles and can take only 40 trips a month. On the other hand, there is an investment in a premium plan. Month one costs $5.99/month or $60/year; Premium + team time tracking costs $7.99/month or $80/year. When it comes to enterprises, the pricing is provided on request.

Overview –

TripLog sets the best example for tracking all employee’s mileage right under one application. There is the functionality of implementing additional expenses through photo capture. The app commences automatically when the vehicle is moving. Activation of on-screen widget counts in real-time.

Specifications –

Innumerable vehicles and drivers on a single tracking system –

Tracking company mileage becomes easier.

Different ways to tracking mileage –

It does have a specification for both manual and automation systems. There is Bluetooth connectivity and compatibility through mileage tracking devices.

Photo Capture for Expenses –

Employees could record receipts for their trips to calculate their expenses.

Integrations –

TripLog is associated with leading industry tools like ADP, XERO and much more.

Drawbacks:

The free version does not support auto-tracking. Mileage is entered manually through the app’s free version. Though one can opt for trying the 15 day trial period to experience the application functioning.

What is it best suited for?

Being one of the best mileage tracking apps, it suits the best for multiple employees with more vehicles. Mileage tracking becomes easier. The free version is mainly of no use.

Hurdlr

The free version of Hrdlr comes with singer use and no auto-tracking functionality. On the other hand, the full version supports an investment of $7.99/month or $58.99/year (paid annually)

Overview –

It is similar to “gig economy” apps. If you are willing to opt for quarterly taxes, it is a boon for you. Estimating in advance makes it easier. As Hudler has other expense tracking capabilities, it will help in solving your expense tracking needs for betterment. If you are having your business, Hudlr could be your rescuer.

Specifications –

Investments –

Hurdlr is completely an expense tracking application. One of its other functionalities is mileage tracking.

App integration –

The app helps in connecting to different online booking platforms like Airbnb, User and more. It helps in tracking down the incomes followed by calculating the expenses.

Bank integration –

It can be easily connected to a business checking account for tracking income and expenses.

Drawbacks:

Reports are that the application runs a little slow. And up to the first time, the tax deduction is hectic.

What is it best suited for?

It is well suited for rideshare drivers and other “gig economy workers”, freelancers and solopreneurs.

Everlance

The free version supports up to 30 trips per month. On the other hand, the premium version comes with an investment of about $8/month or $60/year (paid annually). The businesses working with teams could easily do a lot for pricing on request.

Overview:

Everlance is pretty easy for you. You can track down receipts. It helps in the generation of IRS forms for filing taxes. You could once trip the app for some trips to understand the functionality before switching to the paid version.

Specifications –

User-friendly interface –

Evelerlance is easy to use and highly intuitive in comparison to other similar applications.

IRD Forms –

It helps in the generation of IRM forms that collect mileage deductions.

Photo expense tracking –

Garner the receipt pictures. Save them to the cloud.

Drawbacks:

- The free version supports 30 trips per month. The functionalities are not that high.

- Reviews stated that Everlance fails to connect automatically at the beginning of the trip.

What is it best suited for?

If you are looking for a simple and easy to use the app, Everlance is the one for you. It works best for small businesses.

You have to know that mileage tracking is another form of travel expense. Tracking down the same helps in the reduction of tax obligations. All other miscellaneous forms of costing including food and travel could also be cut off.