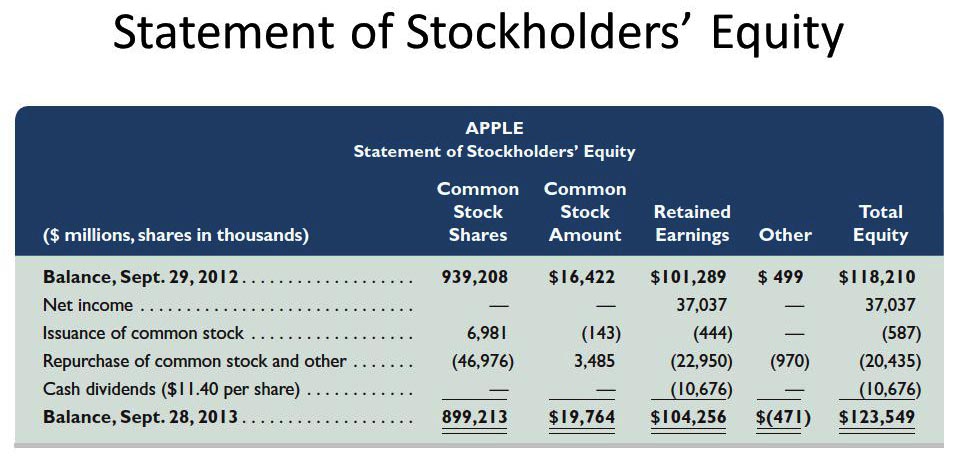

Statement of Stockholders Equity

Any company makes a statement of stockholders equity in the final stage of the office cycle. You can refer to the number of company assets. Besides, you can consider it as a report of stakeholders’ equity. It is the sum of money and put into the company by the owner.

The speech of owners’ equity is a list of all equity accounts. Also, this affects the firm’s final balance. Common stock, extras, net profits, and paid-in funds are in these reports. Besides, changes in equity occur for a single office cycle. So, you think it is a report of changes in equity. It is a design of how you measure the final balance.

It is self-evident that you need net profits to compute the ending equity balance. So, any group should make pay reports before the report of owners’ equity.

Equity components

A statement of stockholders equity has six primary basics. This post has listed the five points below. But, the leading company closes equity. Besides, the report of owners’ equity is for non-controlling interests as the sixth part.

Common stock for Statement of Stockholders Equity

Common stock is the sum that the company’s owners have put into it. Issuing common stock confirms the holding of the company’s shares. As a result, you may sell common stocks with a par value. Besides, you can sell as a stated value or as safeties with no set par value. In rules, you may need a par survey. So, you should report the balance sheet under the equity ratio.

The number of legal shares is the most primary number of shares. As a result, a firm can sell to savers under its charter. Also, every firm must disclose the amount of free and leftover claims.

Preferred shares

Every business term defines stock as either equity or business liability. That depends on its points rather than its legal form. Also, the preferred shares award is the investors’ rights. Besides, these shares are equal to those of joint owners. You can link these liking treats with the receipt of extras. Also, the receipt of assets follows the firm’s closing.

Treasury shares

Treasury stocks trade shares that the firms have rebought. They settle treasury shares on the balance sheet. By the way, the firm has the option to sell these shares. Firms also repurchase their securities. When the owner feels undervalued, it needs the claims to finish equity options.

When bringing back issued shares, you can deduct the value of the used shares from equity. If you reissue treasury safeties later, the firm does not record a benefit or loss on the income report’s reissue. But, treasury shares do not have voting rights. As a result, do not pay the bonus stated by the company.

Retained earnings

The meaning of retained pay is an added amount of standard profits. Also, you do not pay them to the owners of the company as extras.

Total income Statement of Stockholders Equity

You can know net profit in the income report and reflect it in retained earnings. Also, there are other incomes, which you can identify as part of net profit.

Non-controlling interest

Non-controlling interest is the title interest in the minor. By the way, the company owners hold this interest more.

How to make a report For Statement of Stockholders Equity

The speech of stockholder’s interest is one of the most vital fiscal forms. Any company may use other economic words to form a view of the owner’s equity. On the other hand, you should know how to write an owner’s equity as a business auditor. The vital move is as follows. That’s why you collect the information that you need.

Follow the chief data. As a result, we will be able to prepare a statement of stockholders equity.

Opening Balance of Equity Stock and Preference Stock

Take a look at the first balance sheet for the firm. You can find the opening balance of equity stock and preferred stock on the opening balance sheet. The owners’ equity declaration will represent this opening balance.

Treasury Stock

When a company’s stock price drops day by day in the economy, it is a red flag. It will buy its stock. As a value, you should give this stock to owners. But you can not deduct this treasury set from our stock’s opening balance. But, we will calculate the stockholder’s equity as the company issues the same treasury stock.

New Issue of the first choice and equity Stock

A firm may issue new share stock. You will call up that method. If the stockholders pay it, we will record it in the stockholders’ equity statement. We’ll also provide the value.

Retained Earnings

You may add the net profits in total stockholder’s equity. Also, you can add to the report of stockholders’ equity. Add information in the format of a notice of shareholders’ equity. Besides, open the MS Excel, and make the format of this report. In this report, give the above details about the firm. Also, the owners’ equity report is complete.

Calculation of owners’ Equity

The firms have paid loans and other debts. Besides, the investors’ equity is the endless amount of cash. It includes the statement of stockholders equity subtotal in the balance sheet’s lower half.

If the balance sheet is remote, the owner’s equity will fix by putting all assets together and subtracting all charges. The net result of this formula is owners’ equity.

You will also find the balance from individual accounts in the general ledger to measure the shareholders’ equity. That is the total amount of money provided to a company by its owners. They give it in exchange for shares and any other capital or retained earnings.

The formula for Statement of Stockholders Equity?

The core equation is a fast way to get the statement of stockholders equity.

THE FORMULA

Equity = Total Assets – Total Liabilities

The difference between the net assets and total charges is the investors’ equity under this calculation. For instance, if a company’s total assets are $80,000 and its liabilities are $40,000, the shareholders’ equity is $40,000. This formula is the net worth of the company.

To compute net assets for this equity formula, you must use all long-term and existing assets. Cash, list, and accounts are both examples of current assets. This formula is the statement of stockholders equity.

The fixed assets and inventory surveys, such as brands, buildings, and notes, are long-term assets. The firm should have kept these assets for at least a year. It is worth noting that such help’s values. For instance, fixed assets have no chance to match market survey changes.

Add existing charges with short-term duties. Also, add long-term liabilities like bonds payable and loans to get total costs with this equity method.

What Is the Statement of Stockholders Equity

report?

Stockholders’ equity has three significant components. They share capital retained earnings and treasury shares.

THE FORMULA

Stockholders’ equity = Share Capital + Retained Earnings – Treasury Shares.

So, you can consider this formula as the investor’s equation to compute the share capital and learn its retained earnings.

SHARE CAPITAL

The share capital represents aids from owners gathered through the issuance of shares. Also, this capital divides into two separate accounts, common stock, and preferred stock.

RETAINED EARNINGS

Retained earnings, also known as stored profits, represent the growing business earnings minus shares distributed to shareholders.

CAPITAL SHARES

The firm issues treasury shares, which you can buy later. The survey of these bonds reduces stockholders’ equity. Besides, only firms that give shares on the capital exchange are subject to stockholders’ equity. The owner’s equity and partners’ equity are equal terms for sole traders and firms.

How do you find the income statement of stockholders’ equity?

Please find out the income and stockholders’ equity report in its most recent quarterly report. Besides, you can collect these forms from the investor-relations section of the company’s website.

Identify total revenue and any gains

Firstly, find the whole revenue and any gains on the earning statement, such as interest income. Sum up these amounts for counting sheer income. Consider a company earns $500 million in total revenue and $30 million in interest earnings. Finally, add these incomes to get $530 million in total income.

Find out the cost of goods sold and active expenses

Find out the costs of the sold goods, total operating expenses, and any other costs. Besides, any additional prices may include income taxes or losses stated on the income statement. Add these to get total costs. In this example, the company had $300 million in the prices of products sold. Besides, it had $25 million in taxes and $140 million in operational expenses. Add these to get $465 million in total costs.

Subtract entire expenses from total income to get the net income. This example subtracts $465 million from $530 million to gain $65 million in net income. When a negative result comes, it means a net loss.

Find out the statement of stockholders equity at the start of the period. Besides, find out the amount of new stock issued in the “Total” column of stockholders’ equity report. Add these items to the account. In this example, the company had $600 million in starting equity. Besides, it issued $25 million in stock. Add these to get $625 million.

Find the number of cash dividends paid and the amount of treasury stock purchased

Find the number of cash extras paid and the amount of treasury stock bought in the same column. Then, add these items. This example assumes the company paid $11 million in bonuses and bought $6 million in assets. Also, the sum of these is $15 million.

Subtract the Step 6 result from the Step 5 result. Besides, if you computed positive net income in Step 4, add it to this step’s work. You may get the investors’ equity balance at the end of the year. If there is a net loss, please subtract it from this step’s result to figure-end stockholders’ equity. Concluding the example, remove $15 million from $625 million to get $610 million. Add $65 million in net income to $610 million to get $675 million in ending stockholders’ equity. This treasury stock means stockholders’ claim on the company’s assets increased from $600 million to $675 million during the period. Net income paid $65 million.

Benefits of Statement of Stockholders Equity

This equity gives investors a much better understanding of how the individual equity accounts have changed during the period. Besides, the income report shows perfect data of the changes in retained earnings.

Final Verdict about Statement of Stockholders Equity

Finally, a statement of stockholders equity is part of the balance sheet. The three centers are changes in the share capital either by the issue of shares or by selling, or repurchase; current period profit or loss and the dividend payout partial changes in retained earnings; and other comp income movement.

Users of business reports can assume the effort of equity value. It helps to know the business’s performance and fiscal health. Also, it helps to take decisions of the company in terms of share capital and bonus.

Owners’ equity can have a positive or negative impact. If it shows positivity, it points out that its total assets are more than its debt. If it grips negativity, it displays that the companies’ debts are more than its total assets. Negativity may come due to buyback of shares, writedowns, continuous losses. If the negativity continues more times, the company may go bankrupt due to poor business health.