You can see various sorts of profit that a group can have. Also, each kind of process has an alternate rank for the organization’s general income. Many companies have something that refers to as held profit on their monetary records. This number addresses a part of the business’ gain not delivered out as profits. Understanding your organization’s retained profit is significant on the grounds. It empowers you to decide the cash you have accessible for things like reinvestment. Besides, you don’t have a clear thought about “how to calculate retained earnings” at that point in this article.

We talk about the retained income and the way of figuring them. Also, we give cases of this profit.

What are the retained earnings?

You can typify this earning as the total net gain. That remains after any company delivers profits to all investors. It grips if an organization gains a benefit. For this reason, the company pays yield if there’s cash left over after payment of all costs.

When a business has surplus cash after you pay all costs, then you can use this benefit. Except if determined in speculation contracts, organizations don’t need to deliver profits. Financial investors can consent to forego getting profits so that they use services for different purposes.

Many financial backers like to get profits when open. Yet, many states permit pays so that you can treat them as tax-exempt pay. But, gains on stock income are liable, and it is a burden. That is the reason why it is vital to realize how to calculate retained earnings.

The board and Retained Earnings

You can leave the choice to hold the profit. Also, you may deal out among the investors to the organization and the board. In any case, the investors can test through the central party vote as they are the organization’s real investors.

The board and investors may like the group to hold the profit for a few unique reasons. You can educate yourself about the market and the owner’s business. For this reason, the manager may have a deep insight into every project. These insights may see as an option to make a significant profit later on.

Such activities may prompt better returns for the group’s investors over a long time than those acquired from profit payouts. Both companies and investors like taking care of high-interest duties rather than profit installments.

The organizational admin applies an effective system for how to calculate retained earnings. It includes paying out a proper measure of profit and holding a decent segment of the income. Also, it offers a shared benefit.

Profits and Retained Earnings

You can take profit in the form of cash or stock. Both states of dispersion cut retained revenue. Benefit supply causes money outflow. You can report it as net declines in the books and records. As the company turns down the duty for fluid resources in return for monetary benefits, it decreases its resource esteem. Besides, it impacts retained income.

But, stock profit does not trigger a money rush. So, it transfers a part of held income to regular stock. For instance, a company provides one offer as a benefit for each request. You can cut the cost per offer in half because you will roughly double the number of requests. Again, the company has not created any real value by reporting a stock profit. So, the per-share market price fluctuates under the stock profit size.

An increase in the number of deals does not impact the organization’s financial record because the stock price increases. As a result, it decreases the per-share value; thus, it affects the RE.

A progress-oriented company may not pay any profits or pay very little. It will prefer to use the money if it has on hand to finance activities to achieve more growth. In the long run, such companies have a high RE. A growing company may not have many options for its overflow funds. So, it may choose to distribute income. Retained earning lacks in such groups.

The contrast between held income and income

Both income and held profit are significant in assessing an organization’s fiscal wellbeing. However, they feature various parts of the financial picture. Income sits at the highest point of the paid speech. You allude it to as the top-line number while depicting an organization’s monetary presentation. Since income is the all-out pay, you deduct the pay. In certain businesses, net deals call income since the gross figure is before any derivations.

Retained income is part of an organization’s benefit. You can use the retained income for funding change or deliver profits to investors sometime in the not distant future. You can identify retained profits with net pay since it is the total payment sum.

Limitation of Retained Earnings

For a quarter or year, the total held income figure might not give any significant knowledge as an investigator. Throughout some periods, its perception may show the pattern about how much cash an organization is holding. As a fiscal backer, one might want to construe more.

Retained Earning to Market Value

A method to survey an affluent company using the held cash is to take a gander at a critical factor. It is the Held Earnings To Market Value. Besides, you may fix it in some undefined time frames. It may be a few years. Also, it evaluates the change in stock cost against the organization’s net income.

Consider a five-year time frame between September 2013 and September 2017. At this time, Apple‘s stock value rose from $95.30 to $154.12 per share. During a similar five-year time frame, the all-out profit per share was $38.87. Besides, the organization’s absolute profit was $10 per share. You can show up these figures by summarizing income per offer and profit per share for every five years. These figures are accessible under the “Key Ratio” part of the report of the company.

As open to the MorningStar entry, Apple had the add-on EPS and profit figures over the given period. Also, It summarizes offers for the above qualities for all-out EPS and total profit.

The formula for calculating Retained Earning

Suppose the company has a positive result. Besides, it is not the same as when there is a loss.

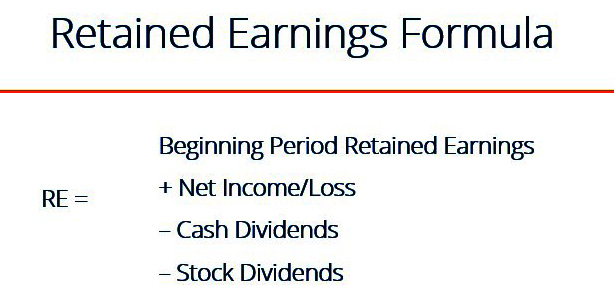

So, the formula for calculating RE in a period of profit is,

RE = RE 0 + NI –D

Where RE = Retained Earning

RE 0 =Beginning Period Retained Earnings

NI = Net Income for the reporting year

D = Dividends

Where there’s a loss, the formula is as follows:

RE = RE 0 – L – D.

Where ‘L’ is the loss. This loss is for the reporting time.

Before calculating a company’s retained earnings, you will have first to figure out the following essential variables in the equation.

- The retained earnings are for the beginning of the period. That is the retained earnings from the last time you calculate it. For instance, a business makes a monthly balance sheet. So, the opening payments for February are the ending retained earnings for January.

- You may get the net profit/loss for the reporting period from the income report.

- The total bonuses (both in cash and stock), paid to the shareholders.

The company has gotten Once these variables, calculating the retained earnings is very easy.

How to calculate retained earnings when a company pays a cash dividend to owners

For example, in November, the business performed well and pooled a massive profit of $15,000. As a result of this enormous profit, the company decides to pay $5,000 to shareholders. Remember, the opening RE is $3,000. That means, on December 1, 2020, they are still using the formula of the retained earnings.

How to calculate retained earnings when you pay a stock dividend to investors

Sometimes, a company may agree to reward its shareholders with bonuses without giving them cash. At such times, the company can decide to issue out such rewards as shares. You call these stock dividends. Besides, take a few extra steps to figure out the dividends’ value as stocks.

The critical step is to determine the fair market value of the company shares. The fair market value is the selling price of a stake in a cheap and open market. Besides, the companies issue the stocks as a percentage of the total shares of the companies.

The formula for calculating retained earnings in this context is:

RE = RE 0 + NI -(# of shares × FMV of each share)

Example of how to calculate Retained Earnings

Organizations record held income under investors’ value on the asset report. So, the figure got a norm. You account it for as a different detail in the organization’s financial record. For example, Apple Inc. (AAPL) ongoing monetary record shows that the organization had held profit of $79.436 billion, as of June 2018 quarter:

Also, the iPhone creator, whose financial year closes in September, had $98.33 billion as held profit as of September 2017:

You can determine the retained profit by adding total compensation to the past term’s held income. Besides, you can deduct any net dividend(s) paid to the investors.

The owners regulate the figure toward the finish of each bookkeeping period. As the recipe recommends, held profit is reliant on the comparing formation of the past term. The vital number may either be positive or negative, contingent on the organization’s total compensation or misfortune.

Then again, the organization delivering huge profits whose nets surpass different figures can likewise prompt held income to go negative. Anything that affects total compensation (or total deficit) will affect the saved payment. Such things incorporate deal income.

What is better between profit or RE?

As we took in, the profit and income are essential for the organization’s gain. In this case, one goes up, and the other goes down. Along these lines, which is better for financial backers or shareholders? In general, financial backers may feel that an organization does not deliver profits or builds its profit. It may happen throughout the following few years.

Yet, this may not be the situation. The organization might be holding the add-up to put resources into different undertakings. So, the organization will develop a reasonable rate. Besides, they may get more pay than the add-up. So, they are bringing about an expanded offer cost of the organization profiting the investors.

Furthermore, this may not be the case, and the administration will be unable to create significant returns. The organization may have lost and lost an extensive sum. The organization utilizes extortion bookkeeping. That is the reason to know how to figure when income is compulsory.

Conclusion on how to calculate retained earnings

Now, we have a good thing about retained earnings. We have additionally seen the recount. The organization’s admin can do it to keep a great benefit. As a result, the investors can meet the company’s capital necessities. So that compensates financial backers for their venture.

Here is the article about how to calculate retained earnings. Yet, you need to investigate more experiences identified with something similar or on other components. Then toss your inquiries in the remark segment. Here, our help is ready to give every one of the inquiries you have. The colleague will assist you with getting out the entirety of your issues. You can drop an email or do a live talk for on-spot help.